VAT in the Digital Age

ViDA reforms with three pillars

It is important to note that the ViDA package is not in a final version. The European Commission published ViDA reforms proposal in December 2022 and currently, EU Member States, businesses, sector associations are reviewing them. The proposal will need to receive unanimous approval by all EU Member States, which may require further changes or additions to the proposed measures. The timetable proposed by EU Commission is very ambitious and it is very likely that some terms will be postponed due to the time required for an implementation to national legislations.

(i) VAT reporting obligations and e-invoicing

E-invoicing

- In the first phase, each Member State may impose mandatory e-invoicing for cross-border B2B transactions and at the next phase, e-invoicing will become the default system for intra-Community supplies of goods and services. Paper invoices will only be possible in situations where Member States authorise them.

- E-invoicing must follow the EN 16931 standard and only be in electronic structured format. The PDF files will no longer be accepted. E-invoicing will no longer be subject to the acceptance of the recipient.

- E-invoicing will no longer be subject to the agreement of the customer and therefore businesses must be prepared to receive e-invoices. France, Poland, Belgium and Spain plan to be the first to introduce mandatory e-invoicing from July 2024.

- Abolition of issuance of Summary VAT invoices will be ended.

- Practical issues with self-billing are expected.

Digital Reporting Requirements (hereinafter as ‘DRR’)

- DRR will cover all B2B cross-border transactions within the EU.

- DRR will replace the current recapitulative statement (also known as EC Sales List) and be filed electronically in near real-time.

- Each Member State can decide whether to introduce DRR for domestic transactions with the same e-invoicing rules as well.

(ii) VAT treatment of the platform economy

- Platforms will be liable for VAT for short-term accommodation and passenger transport services.

- Extension of the deemed supplier rules for platforms.

- Clarification of the place of taxation of intermediary services provided to B2C.

- Mandatory usage of IOSS for marketplaces.

(iii) Single VAT registration

- Extension of the OSS return to own stock movements across EU borders and B2C local supplies (domestic supplies of goods, supplies with installation or assembly and more).

- EU Member States should allow an option for application of domestic reverse charge mechanism on supplies performed by non-established supplier to customer with a local VAT number (i.e. option to shift VAT liability to its customer).

- Phase out of the call-off stock simplification.

- Scope of the non-EU OSS extended to all B2C services realized by non-EU suppliers, even if customers are not established in the EU.

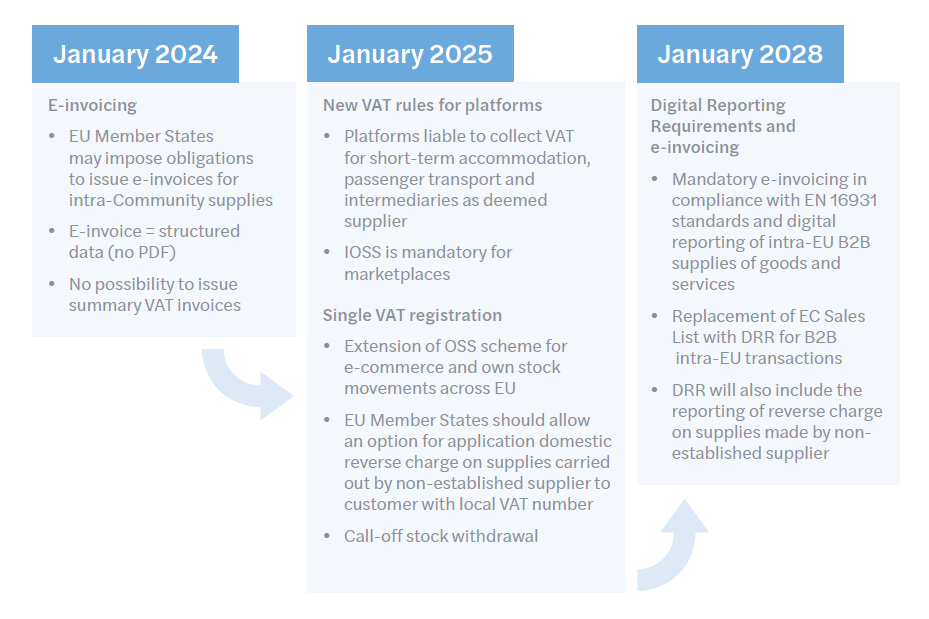

If above mentioned reforms will be adopted, according to the plan of the EU Commission, they should gradually enter into force from 1 January 2024 to 1 January 2028. Please see the summary of the main changes and proposed timeline below.

In case of your interest, we would be glad to provide with the information on upcoming changes in the detail and discuss particular situation with you.

Authors:

Evgeniya Rudneva, Tax Senior

Petra Slobodzianová, Tax Manager