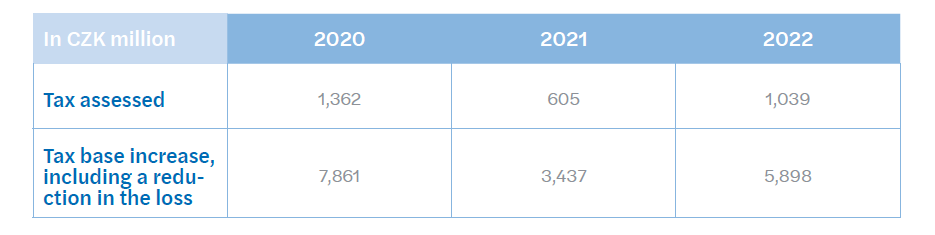

Transfer pricing controls on the rise again

Transfer pricing controls on the rise again

Therefore, it is worth recalling the main pitfalls most often encountered in connection with transfer pricing tax audits:

The economic substance (including the benefit test) of management fees and licence fees

Particularly in the case of intercompany service fees, the tax authorities rigorously examine whether the conditions for tax deductibility are met. In practice, many of additional tax assessments are due to the taxpayer's inability or unpreparedness to prove (i) what specific services were actually received, (ii) what benefit they provided and (iii) that the price was reasonable. However, it should be noted that the tax authorities usually adopt a very strict and formalistic approach, requiring impeccable and extensive means of evidence, while at the same time often seeking to challenge its credibility and conclusiveness on the basis of any (even the slightest) errors or shortcomings.

Compatibility of functions performed with risks borne

In general, a taxpayer must not bear risk in areas over which taxpayer has no control and where he is bound by the decisions of another related party; otherwise, the group should adequately compensate the taxpayer for respective risk. In our experience, there are a number of companies that do not perform strategic decision-making functions but are exposed to the associated risks, which is considered as a breach of the arm's length principle. Moreover, the whole area of proving the so-called functional and risk profile of a taxpayer is difficult in practice, if the individual functions are not well formalised and the risks are not contractually covered.

Parent company order

In connection with the above-mentioned point, the tax authorities often also examine whether the taxpayer has received reasonable compensation for a so-called 'parent company order', which is defined as any influence on an independent transaction by a decision of the parent company (or other related party). Typically, this may be the case, where a subsidiary manufactures and supplies products for an external customer but at prices agreed between the customer and the parent company.

Whether the taxpayer has been adequately remunerated by the group for its contribution to DEMPE functions (for intangible assets)

Legal ownership of an intangible asset does not automatically create a right to collect the entire revenues generated from the use of such intangible asset. On the contrary, each member of the group should be compensated for its contribution on functions relating to the development, enhancement, maintenance, protection and exploitation of the intangible asset, taking into account risks borne and assets applied (so-called DEMPE functions).

Financial transactions

It is no longer sufficient to prove that interest rate is based on arm's length principle. Nowadays the tax authorities are also focused on the economic substance of the transaction itself: for example, whether the loan was not a capital increase (in which case the entire interest may be tax-deductible); or whether the cash pooling is actually used for liquidity management or it should be recognized as a long-term loan (which should be taken into account when determining the interest rate).

Whether the taxpayer received adequate compensation from the group in case of undertaken business restructuring.

Whether the costs or losses caused by the COVID-19 pandemic have been correctly reflected in the transfer pricing methodology and whether these costs do not incorrectly reduce the taxpayer's arm's length profitability.

Whether the increased energy costs incurred by the taxpayer have been correctly reflected in the cost base and whether these costs do not incorrectly reduce the taxpayer's arm's length profitability.

Our specialists are ready to provide you with any further information you may require.

Authors:

Vít Fritzsche, Tax Manager

Ivo Žilka, Tax Manager