Introduction to Top-Up Taxes

These taxpayers include:

- Legal entities (and their permanent establishments) and entities without legal personality preparing financial statements that are part of

- large multinational or domestic groups of companies, whose

- consolidated annual revenues reported in the consolidated financial statements of the ultimate parent entity in at least 2 out of the 4 reporting periods immediately preceding the relevant tax period amount to at least 750 million euros.

The aforementioned groups will have to pay such a tax on profits earned in each country where they have a branch or other tax presence to ensure that their effective tax rate reaches a minimum of 15%. If existing taxation systems do not ensure this taxation, then newly introduced top-up taxes will ensure it.

The obligation to ensure that an effective taxation rate of at least 15% is maintained for each country where the group is present primarily lies with the ultimate parent entity (UPE). If it is based in a country with qualified top-up tax rules, it will pay the required tax for itself and other countries in that very country. If it is not based in such a country, the obligation to ensure taxation will be transferred to another parent entity or entities within the group according to detailed rules. Furthermore, the UPE (or another parent entity) will not pay top-up tax for a country that has introduced a so-called qualified domestic top-up tax. This tax preserves the primary right of that country to tax profits earned within it. The Czech Republic has introduced this tax, called the Czech top-up tax.

The rules for calculating top-up taxes, especially the calculation of the effective tax rate according to GloBE rules, are very complex, so we dedicate the introduction to a brief explanation of the rules of the so-called transitional safe harbour, which will temporarily avoid the need to perform a complete calculation of the effective tax rate and the top-up taxes.

Transitional Safe Harbour

The introduction of the transitional safe harbour aims to temporarily reduce the administrative burden associated with the complex calculation of top-up taxes for tax periods commencing no later than January 1, 2027, and ending no later than June 30, 2028.

The transitional safe harbour exception may apply if at least one of three tests is met, each conducted at the level of individual countries (i.e., for all member entities in a given jurisdiction). Meeting at least one test means that the top-up tax for the given country (jurisdictional and, in the case of the Czech Republic the Czech top-up tax as well) will be considered nil without any further calculations. However, if it is not possible to apply the exemption in one (e.g., in the first) year, it will not be possible to use it in subsequent years of the transitional period.

All three tests are based on data contained in the Country-by-Country reporting (CbCR), which must be a report compiled based on qualified financial statements.

De Minimis Test

The test is met if the large multinational group in the jurisdiction shows:

- Total revenues lower than 10 million euros and

- Total pre-tax earnings lower than 1 million euros

Simplified Effective Tax Rate (ETR) Test

The test is met if the simplified effective tax rate of the large multinational group for the jurisdiction corresponds to at least the transitional tax rate applicable for the respective period, namely:

- 15% for fiscal years beginning in 2024 (or on December 31, 2023)

- 16% for fiscal years beginning in 2025

- 17% for fiscal years beginning in 2026

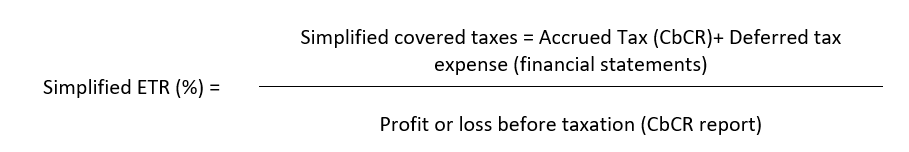

The calculation of the simplified ETR is as follows:

Routine Profits Test

This test is met if the pre-tax earnings of the large multinational group in the jurisdiction are equal to or lower than the substance-based income exclusion amount (profit amount calculated based on the return on assets and wage costs in that country).

Calculation:

Profit or loss before taxation (from CbCR) <= Substance-based income exclusion amount

Substance-based income in individual years is equal to the sum of:

- 7.8% of the accounting value of eligible tangible assets and 9.8% of eligible wage costs of employees performing activities for the group in that country, for the year 2024

- 7.6% of the accounting value of eligible tangible assets and 9.6% of eligible wage costs of employees performing activities for the group in that country, for the year 2025

- 7.4% of the accounting value of eligible tangible assets and 9.4% of eligible wage costs of employees performing activities for the group in that country, for the year 2026, etc.

The application of the transitional safe harbour rule is temporary and voluntary, but we assume that due to simplified calculations (especially in the simplified ETR test), this rule will be widely used.

If a group does not use or cannot use the transitional safe harbour option (none of the above tests is met), it will be required to calculate the effective tax rate and top-up taxes according to complex rules. Below, we will attempt to briefly describe these rules, omitting specifics or exceptions due to their complexity.

Basic Parameters of Top-up Taxes

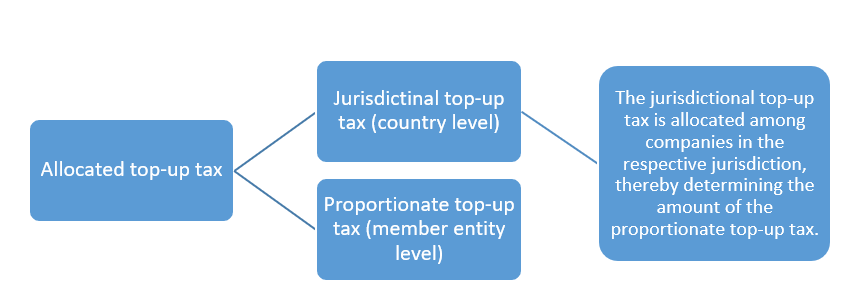

The Czech Act on Top-up Taxes introduces two top-up taxes: allocated top-up tax and domestic top-up tax. These taxes are further divided into:

Allocated Top-up Tax

The allocated top-up tax should primarily be paid in the country of the parent entity, i.e., the parent entity pays tax for its low-taxed entities in its own country according to the Income Inclusion Rule (IIR). As mentioned above, the parent entity does not pay the allocated top-up tax for a state that has introduced a so-called qualified domestic top-up tax.

For completeness, if the IIR rule is not used or if there is still part of the allocated top-up tax after its application, this tax or its remaining part will be paid by individual entities according to the kind of a backup rule for undertaxed profit.

The Czech Republic has utilized the option to introduce a domestic top-up tax with rules for its calculation that should result in it being considered as qualified. Therefore, if Czech entities of large groups are required to pay top-up tax, this tax will be paid in the Czech Republic and will not be allocated to any parent entity abroad.

Domestic Top-up Tax

The domestic top-up tax corresponds to the method of calculating jurisdictional top-up tax (at the country level).

The following calculation, with minor deviations, therefore essentially represents the calculation of the domestic top-up tax.

Calculation of Jurisdictional Top-up Tax - Effective Taxation

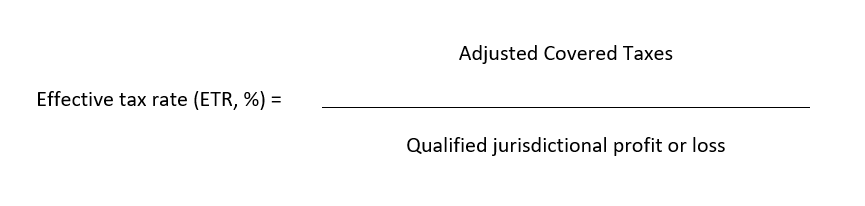

The effective tax rate is determined for the entire country, i.e., in aggregate for all entities of the same group in this state. If the rate does not reach 15%, the difference must be equalized up to this level through top-up taxes.

Calculation of ETR:

Selected taxes on corporate income

- Due tax shown in financial statements (not the tax actually paid)

- Windfall tax

- Taxes on profit share pay-out

- Adjusted deferred tax (recalculated at the minimum rate)

Selected adjustments

- + deferred tax asset arising from qualified loss

- +- summary of deferred tax adjustments

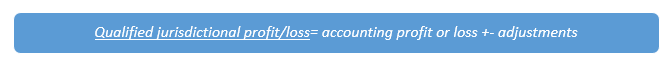

Accounting profit/loss

- Derived from the values for the preparation of the consolidated financial statements of the parent company before consolidation adjustments (i.e., includes intra-group transactions).

- Based on accounting standards, which include International Financial Reporting Standards (IFRS) and generally accepted accounting standards of Australia, Brazil, China, EU and EEA member states, Hong Kong, India, Japan, Canada, Republic of Korea, Mexico, New Zealand, Russia, Singapore, United Kingdom, USA, and Switzerland.

Selected adjustments

- + tax expenses

- + impermissible expenses (fines, penalties, etc.)

- - excluded profit shares

- +- included gains or losses from revaluation

- +- selected gains or losses on disposal of assets and liabilities

- +- asymmetric exchange differences

- +- errors from previous periods and changes in accounting policies

- +- price adjustments between related parties, etc.

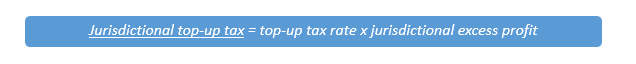

In case the effective tax rate (ETR) is lower than 15%, the balancing tax rate will be calculated as the difference between the 15% rate and the calculated ETR.

The tax top-up rate will then be applied to the jurisdictional excess profit, which is the qualified jurisdictional profit– Substance-Based Income Exclusion.

Allocation

For the purposes of allocating top-up tax, the jurisdictional top-up tax is first calculated, as mentioned above, which is subsequently allocated among all entities in the given state – each entity will thus be allocated a so-called proportionate top-up tax. The final amount of proportionate top-up taxes allocated to the parent entity depends on the ownership stake of the parent company in the specific entity.

Unlike allocated top-up tax, Czech top-up tax will only be allocated to those member entities in the Czech Republic whose effective tax rate does not reach 15%. Czech entities whose own effective tax rate reaches at least 15% will not be burdened by Czech top-up tax "caused" by other member entities.

We will address the rules for selecting and managing top-up taxes in one of the upcoming Mazars Tax Views.

Authors:

Pavla Vítková, Tax Manager

Olga Těhlová, Tax Senior